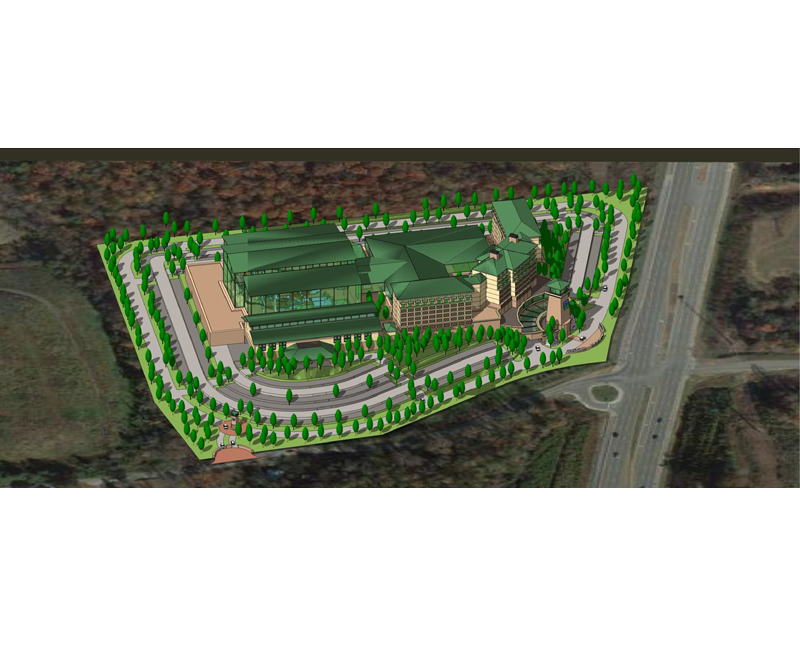

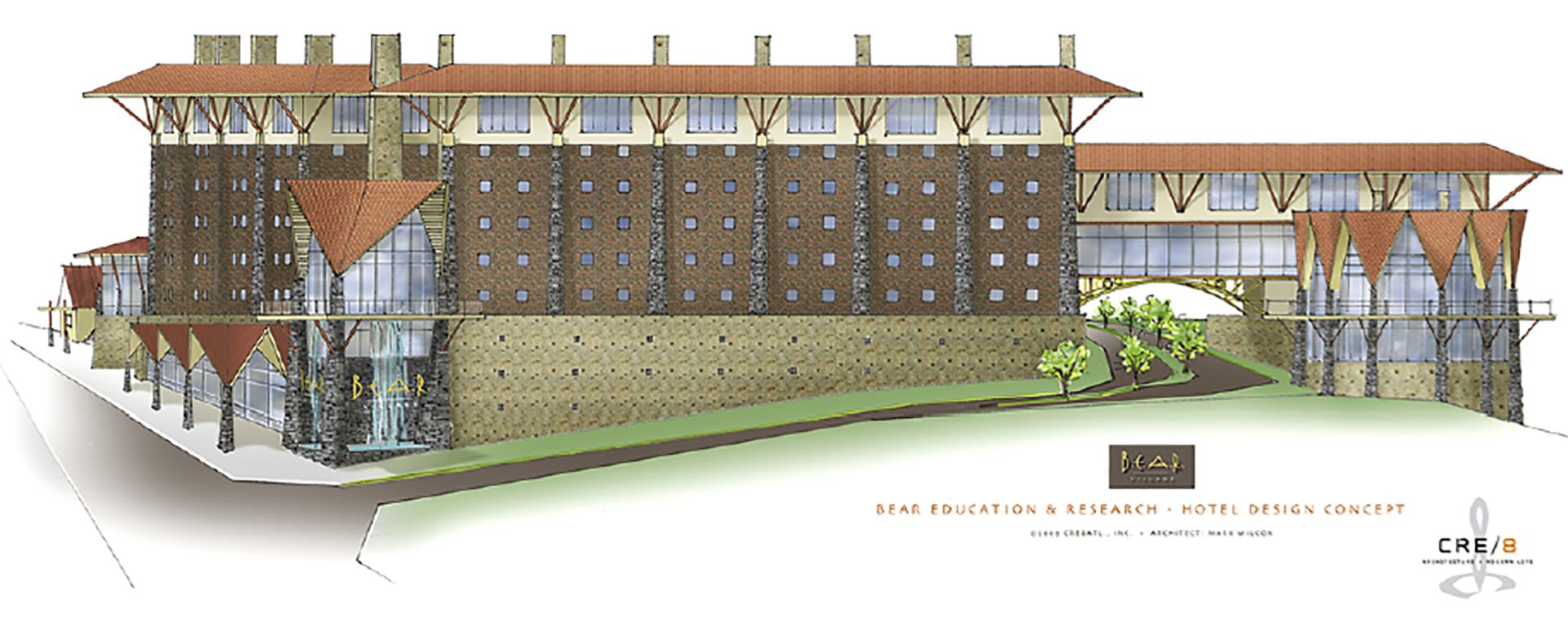

We plan to create a community of unforgettable family experiences with 80,000 sq. ft. of indoor water park, a 60,000 sq. ft. adventure park, a 15,000-gallon freshwater aquarium, a 90,000 sq. ft. family entertainment center, a 20,000 sq. ft. banquet center, a state-of-the-art sports bar, and so much more.

Why Invest In B.E.A.R. Village?

Creative & Eco-friendly

Strong Business Model

Experienced Leadership

INVESTOR OPPORTUNITY

BEAR VILLAGE, INC. is seeking investors to fund continued site development. The minimum investment amount is $500 with Reg A Tier II, raising up to a maximum total amount of $50M for the planned project development, construction, operations, initial setup, and management. Our Investment Banking partner, Network 1 Financial Securities Inc. will guide our Reg A+ crowdfunding process and create the portfolio to be managed by one of the experienced asset management firms that we are working with: Morgan Stanley, Bank of America, and Merrill Lynch.

INVESTOR OFFERING SUMMARY

Bear Village, Inc. has identified the drive to destination resort market as its primary interest and focused its efforts on the development of a premiere Family Destination Resort featuring Eco-Friendly, Eco-Tourism in conjunction with education in a heavily themed Resort. Initial developments will focus on Tennessee and Georgia. The Company has two resorts in development. The first, in Pigeon Forge, TN is the furthest developed. A second property located in Jackson County Georgia is undergoing initial site layout. Additional properties will be acquired as destination resort demographics are evaluated. The goal is to provide family getaway resorts to urban and suburban communities that are within a five -hour driving radius of the resorts.

GET INVESTMENT INFORMATION

Register below to get access to our investment documents, including the Bear Village Resorts Business Plan, Market Feasibility Study, Private Placement Memorandum, and Investment Policy Statement.

Legal Disclaimer & Forward-Looking Statements

This investor information page may include certain forward-looking statements that are based upon current expectations, which involve risks and uncertainties associated with Bear Village Inc. and the environment in which the business operates. Any statements contained herein that are not statements of historical facts may be deemed to be forward-looking, including those identified by the expressions “anticipate”, “believe”, “plan”, “estimate”, “expect”, “intend” and similar expressions to the extent they relate to the Company or its management. The forward-looking statements are not historical facts but reflect the Company’s current expectations regarding future results or events. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. Bear Village Inc. assumes no obligation to update the forward-looking statements or to update the reasons why actual results could differ from those reflected in the forward-looking statements.

Note that the Company’s actual results or activities or actual events or conditions could differ materially from those projected by the Company from such forward-looking statements. The plans, strategies, and intentions of management may change based on increased experience with the Company’s business model as well as in response to competition, general economic trends, or perceived opportunities, risks, or other developments. Projections concerning the Company’s future results of operation and expansion plans are based on a number of assumptions and estimates made by management concerning, among other things, customer acceptance of and demand for the Company’s services and products, the timely availability of capital on acceptable terms, the Company’s ability to identify to attract and retain qualified support staff and personnel, research and development costs and expenses and other future events and conditions. These estimates and assumptions are believed by management to be reasonable but are dependent upon facts and conditions that are uncertain and unpredictable. To the extent that actual events differ materially from management assumptions and estimates, actual results will differ from those projected.

You can learn more about investing in Regulation D and Regulation A offerings from the SEC or FINRA.